Revealing the key benefits and features of the Citi Simplicity card

Anúncios

The Citi Simplicity Credit Card is known for its deals that cater to individuals seeking to handle existing debt or finance new purchases without immediate interest charges. This card offers an APR period, for both balance transfers and purchases varying based on the applicants application timing and creditworthiness.

This initial period can lead to savings on interest making it a smart option for those looking to pay down existing balances or make new purchases with a flexible payment plan. Moreover the Citi Simplicity Card is distinguished by its lack of fees commonly associated with credit cards. It does not have a fee, late fees or penalty APR providing cardholders with peace of mind and financial relief if they miss a payment deadline occasionally.

Anúncios

However it’s worth noting that this card does not feature a rewards program or cash back incentives; instead it focuses on simplifying management through its fee and interest policies. Despite the absence of rewards the card is often recommended for its assistance, in reducing debt without the distraction of earning points or cashback perks.

Citi Simplicity Card Overview

The Citi Simplicity® Card is designed for people who value an uncomplicated credit card experience. It doesn’t have any fees allowing users to concentrate on managing their finances without worrying about costs. One of its standout features is the 0% APR period, for both balance transfers and purchases giving a significant advantage to individuals looking to consolidate debt or make big purchases without paying interest, for an extended time.

Anúncios

This feature makes the card especially appealing to those aiming to reduce debt or handle expenses effectively. Furthermore the cards absence of fees and penalty rates adds to its appeal by providing flexibility and peace of mind for those who occasionally miss payment deadlines.

Basic Features

- No annual fees

- Balance transfers and purchases introductory APR periods

Interest Rates and Fees

Feature Detail:

- Introductory APR for Purchases: 0% for 12 months from the date of account opening;

- Introductory APR for Balance Transfers: 0% for 21 months from the date of the first transfer;

- Balance Transfer Fee: 3% ($5 minimum) during the first 4 months of account opening;

- Regular APR: Varies based on the applicant’s creditworthiness post introductory periods.

Rewards and Benefits

- No rewards or cash back offerings.

- The primary benefits include the lack of an annual fee and extended introductory APR periods.

Citi Simplicity Card Application Process

The process to apply for the Citi Simplicity® Card is really easy. Starts, by confirming your eligibility with some personal and financial details. You kick things off by sharing information like your name, address, income and social security number. Once you’ve entered this info your application will be checked promptly.

Citis online application system is user friendly. Walks you through each step for a hassle free experience. Once you’ve filled out the form you’ll send in your application for review. Citi usually gives a decision quickly. If approved your new card will arrive in the mail soon all set for you to manage your finances without any fees and enjoy a 0% APR period, on purchases and balance transfers.

Eligibility Requirements

Applicants must meet certain criteria to qualify for the Citi Simplicity® Card. They:

- Must be at least 18 years old.

- Should possess a valid Social Security number or Individual Taxpayer Identification Number.

- Need to have a physical U.S. address.

- Require sufficient income to afford monthly minimum payments.

- Must have at least good credit to be considered for approval.

Application Steps

The steps to apply for the Citi Simplicity® Card are as follows:

- Visit Citi’s Website: Access the official application online.

- Enter Invitation Code (if applicable): Some applicants might have a specific invitation code.

- Fill in Personal Information: Provide details such as name, address, and financial information.

- Read Terms and Conditions: Applicants should carefully review all rates, fees, and terms.

- Submit the Application: After reviewing, submit the application for processing.

- Await Approval: Citi will review the application and inform the applicant of their decision.

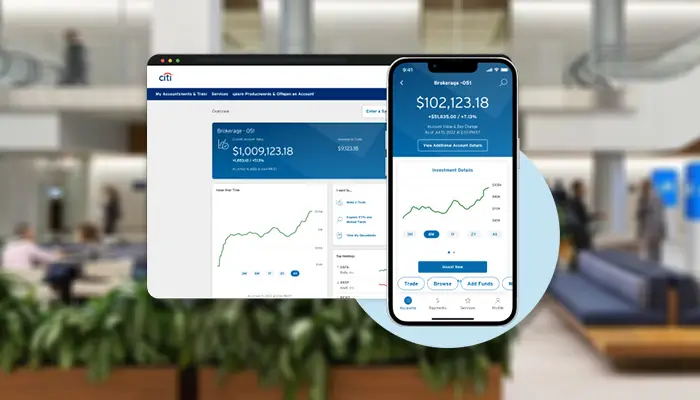

Account Management

Managing your Citi Simplicity® Card account effectively is key, to a customer experience. The card provides users with a range of tools and resources to stay on top of their finances. With to use banking features account holders can securely access their balances track recent transactions and manage payments. The Citi mobile app takes this convenience further by allowing customers to monitor and handle their accounts while on the move.

Users can receive alerts set up payments and even check their credit score for free, through the app. Moreover Citi offers customer support via phone. Chat services to promptly address any questions or concerns. These various options empower account holders to stay in charge of their finances. Maximize the perks offered by the Citi Simplicity® Card.

Online Banking

Citi Simplicity® cardholders can manage their accounts online through the Citibank website. This platform allows users to check balances, view statements, and monitor recent transactions with ease. It also offers functionalities to pay bills, set up automatic payments, and transfer funds. Registration for online access provides cardholders a streamlined banking experience.

Mobile App

The Citi Mobile® app delivers a convenient platform for Citi Simplicity® users to control their finances on the go. They can instantly access account details, make payments, and even lock their card if it’s lost or stolen.

- Key Features:

- Real-time account monitoring

- Secure biometric login (fingerprint or face recognition)

- Scheduled payments and balance transfers

This ensures customers can manage their account anytime, anywhere.

Customer Service

Citi is known for its commitment to customer service. Citi Simplicity® cardholders can contact customer support for assistance with their accounts through various channels:

- Phone Support: Available 24/7 for prompt resolutions.

- Online Chat: A quick option for real-time help without making a call.

- Citi Help Center: Provides answers to frequently asked questions and guides for troubleshooting common issues.

Accessibility and quality service are keystones of the customer service approach for Citi Simplicity® card management.

Comparative Analysis

In this part the Citi Simplicity® Card is compared to cards, in the market to assess its position. The card is notable for its absence of fees and high penalty rates making it an attractive option for individuals looking for flexibility in managing their payments. Moreover it provides an 0% APR period for both purchases and balance transfers making it appealing to those interested in consolidating debt or making significant purchases without accruing interest charges.

However some consumers may find the lack of cashback rewards. Points a downside compared to offerings from cards that focus on rewards programs. The Citi Simplicity® Card is highly regarded for its terms and user friendly interface. Its emphasis on minimizing fees and interest rates positions it as a competitor in the market, for individuals who value simplicity and transparency in their credit card choices.

Competitor Credit Cards

The Citi Simplicity Card is frequently compared to the Citi Diamond Preferred Card as both cards offer a range of benefits, to users. The main differences lie in their customer ratings and initial promotions. The Citi Simplicity Card has a consumer rating of 3.7 out of 5 which’s similar to the Citi Diamond Preferred Cards rating of 3.7 out of 5 well. In terms of deals the Citi Simplicity Card offers a 0% APR for 21 months on balance transfers starting from the first transfer date along with a 0% introductory APR for 12 months on purchases, from the account opening date.

Market Position

When analyzing where it stands in the market the Citi Simplicity Card is marketed as an option, for balance transfers for those wanting to combine debts and reduce interest expenses. One of its features is the prolonged 0% APR period, which sets it apart in the credit card field. However once this introductory period ends the APR becomes variable at a rate ranging between 15.49% and 25.49% falling within the range for this industry.

Consumer reviews of the card indicate that it enjoys a reputation among users consistently performing well and holding its own against cards in its category. The fact that there are no fees or penalty rates further cements its standing, among individuals seeking a simple and cost effective credit solution.

User Reviews and Testimonials

The Citi Simplicity® Card garners a mix of reviews from users, indicating both satisfaction and some concerns. The general sentiment highlights appreciation for the $0 annual fee and the lengthy 0% introductory APRs, with users frequently mentioning the 21-month period for balance transfers and the 12-month period on new purchases as notable benefits.

Positive Reviews:

- Users commend the ease of balance transfers and the absence of late fees.

- The card receives praise for being a helpful tool in debt management and reduction.

- The simplicity of the card’s terms and conditions is often highlighted, living up to its name.

| Review Aspect | User Opinion |

|---|---|

| Introductory APR | Often cited as a major draw for users. |

| Annual Fee | $0 fee is highly appreciated among cardholders. |

| Complexity | The straightforward nature is positively noted. |

Negative Reviews:

- Some customers express disappointment regarding rewards, noting the lack of cash back or points system.

- Critics often point out less competitive standard APR rates post-introductory period.

- A few testimonials reflect on customer service experiences that did not meet their expectations.

Users looking to leverage Citi Simplicity for its introductory offers find it valuable, particularly in planning for large purchases or transferring existing balances. However, those seeking rewards or low long-term rates may not find this card as favorable.