The Future of Traditional Financial Institutions in the Digital Age

Anúncios

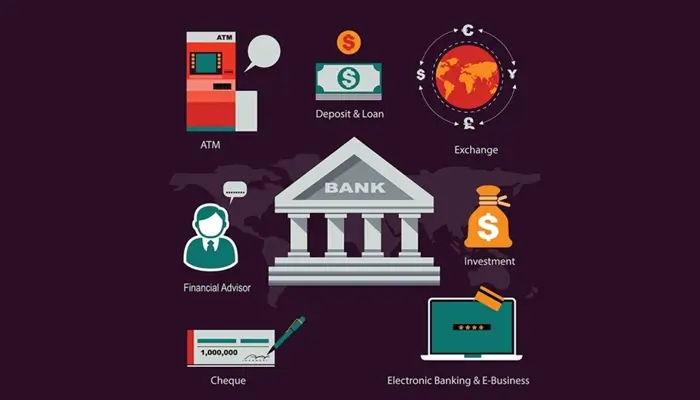

The finance sector is undergoing a shift driven by the growth and incorporation of financial technology commonly referred to as FinTech. With the emergence of services, from FinTech firms BigTech companies and neobanks traditional financial institutions are faced with the need to evolve to stay relevant. The contrast between the standing trust in banks and the efficiency of modern FinTech solutions sets the stage for a changing landscape. This transformation is propelled by consumers increasing preference for transactions leading to a shift from in person to online banking services reshaping how these institutions operate.

While many bank branches have closed and there is a push towards digitalization traditional banks maintain their role within the financial system. They continue to provide customer advisory services and handle day to day transactions. The key challenge for these institutions in todays era lies in leveraging their established reputations and large customer bases while embracing advancements.

Anúncios

In order to secure their success these institutions are exploring strategies for transformation that enhance their business models without compromising their core principles. Their goal is to meet customer expectations, for transparent services by integrating tools that can improve business functions and capabilities. The adventure entails finding a harmony, between their established presence and the evolving digital landscape reshaping the financial services sector.

Evolution of Financial Institutions

The future success of institutions hinges greatly on their ability to smoothly incorporate digital advancements despite the complex challenges posed by existing systems and modern technologies. Embracing transformation involves not updating technological infrastructure but also fundamentally reshaping operational procedures and customer engagements. Moving from banking methods to digital platforms presents various hurdles, including concerns, about data security navigating regulatory requirements and fostering organizational cultural changes.

Anúncios

Additionally as fintech innovators continue to transform the industry with business models and creative solutions traditional institutions must innovate and adjust to stay competitive. Achieving success involves finding a balance between utilizing the benefits of established systems, like customer bases and compliance knowledge while also embracing technological progress to meet the changing demands of customers in an increasingly digital era.

Adapting to Digital Innovation

Financial organizations have reached a stage where embracing advancements is key. Starting from the 1960s technological progress has been reshaping the sector, a trend that gained momentum with the widespread use of the internet, in the 1990s. Nowadays these institutions are evolving by incorporating innovations, like blockchain, artificial intelligence (AI) and machine learning (ML) to expand their services and cater to the changing needs of the era.

Legacy Systems versus Modern Technology

Many traditional financial companies face challenges when upgrading from systems to newer technology. While the old systems are sturdy and safe they lack flexibility. Can be expensive to upkeep. On the hand modern technology brings agility, cost efficiency and enhanced customer interactions. These institutions need to find a balance, between keeping their secure legacy systems and embracing the flexibility and innovation that come with technology to stay ahead in an ever evolving digital world.

Impact of Fintech on Traditional Banking

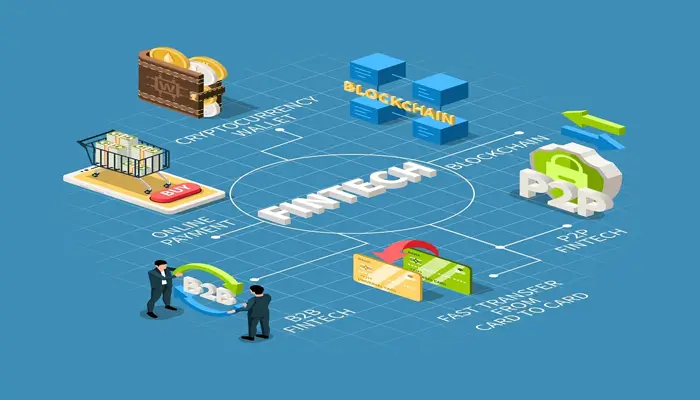

The inclusion of technology (Fintech), in the banking industry signifies a change fundamentally transforming how traditional banks operate and provide services to their clients. Fintech advancements include tools like mobile banking applications, peer to peer lending platforms, blockchain technology and robo advisors all designed to improve efficiency, accessibility and user experience in financial services.

For banks adopting Fintech presents both opportunities and hurdles. While it enables banks to streamline operations cut costs and reach customer segments through means it also requires adapting old systems navigating regulatory challenges and competing with agile Fintech startups for market share. Nevertheless integrating Fintech is unavoidable for banks aiming to stay competitive and relevant in a changing world. This compels them to innovate and cooperate with Fintech partners to meet the evolving needs and expectations of customers, in the era.

Collaboration and Competition

Fintech firms bring forth services frequently sparking partnerships, with established banks to provide improved digital offerings to clients. They collaborate on aspects like payments and peer, to peer lending platforms to stay in the competitive landscape. On the side fintech can function autonomously from banks fostering competition that drives institutions to adjust their strategies and hasten their digital evolution to keep up with market demands.

Collaborations:

- Mobile payment solutions;

- Peer-to-peer lending services;

- Digital financial advisory.

Competition Factors:

- Alternative lending platforms;

- User-friendly financial management apps;

- Cryptocurrency services.

Regulatory Challenges

The emergence of Fintech has led to adjustments, in guidelines. Conventional banks encounter the dilemma of following a set of rules that might not be as relevant to fintech firms. Consequently they have to maneuver through these variations, in demands while also welcoming the advancements that fintech introduces.

Regulatory Aspects:

- Consumer protection laws;

- Anti-money laundering (AML) rules;

- Data privacy and cybersecurity standards.

Consumer Expectations

The presence of fintech has shifted consumer expectations, setting new standards for convenience and efficiency in banking services. Traditional banks must now meet demands for instantaneity, personalization, and 24/7 access to services, which are hallmarks of fintech offerings. They face the additional challenge of integrating new technologies to meet these expectations while maintaining trust and security.

- Consumer Demands:

- Instant access to funds and account information;

- Personalized financial advice and product offerings;

- Seamless online and mobile banking experiences.

Strategies for Digital Transformation

In todays era traditional financial institutions must make specific moves to remain competitive and relevant in a tech world. This includes investing in technology infrastructure to modernize their operations streamline processes and strengthen cybersecurity measures. It’s crucial for them to embrace banking since more people are opting for the convenience of managing their finances on the go using smartphones and tablets. Moreover improving the customer experience, across all touchpoints.

Is essential for retaining existing customers and attracting new ones. This involves optimizing user interfaces offering personalized services and ensuring interactions, across different channels. By focusing on these strategies traditional financial institutions can not just meet changing consumer demands. Also set themselves up for growth and success in the digital age.

Investing in Technology

Financial companies are quickly putting money into cutting edge technologies to make their operations more efficient and provide services. Artificial Intelligence (AI) and Machine Learning (ML) are being used to offer tailored advice and automate risk assessment. Incorporating cloud computing resources helps improve scalability and accessibility to services.

Embracing Mobile Banking

The advent of banking has revolutionized how individuals engage with their institutions. It is imperative for banks to create easy, to use mobile apps that enable users to perform tasks such as depositing checks transferring money and managing their accounts in time. Implementing two factor authentication is essential, for enhancing the security of these applications.

Enhancing Customer Experience

Improving the customer experience is crucial. Banks are using chatbots to provide the clock customer support and tailoring interactions to customer preferences. They are also enhancing their websites and mobile apps for user navigation making it easy for customers to access and utilize services, with speed and convenience.

Future Outlook

Financial firms are, on the brink of changes due to the blend of advancements and shifting consumer needs. It is crucial for them to adapt strategically and invest in innovation to navigate this changing landscape successfully. By adopting technologies like intelligence, blockchain and data analytics financial institutions can improve efficiency customize customer experiences and manage risks more effectively.

Understanding evolving consumer preferences is vital for offering products and services that cater to the changing demands of customers in a world. Embracing change proactively and focusing on innovation can help financial institutions establish themselves as leaders in the era fostering growth and competitiveness, in a dynamic market environment.

Predicting Industry Trends

The world of finance is poised to see a rise, in technology (fintech) startups, known for their nimbleness in introducing creative products swiftly. Traditional banks are anticipated to react by either partnering with these fintech firms or developing their tech solutions to stay competitive. Artificial intelligence (AI) and machine learning are set to be crucial in molding services, like tailored banking experiences and risk evaluation. Additionally automation is expected to revolutionize processes potentially cutting costs and boosting efficiency in establishments.

Potential for Disruption

The financial industry is, on the brink of changes driven mainly by the incorporation of technologies, like blockchain and cryptocurrencies. These innovations bring perspectives to payment methods and wealth management shaking up banking norms. Institutions that do not embrace these technologies face the prospect of losing customers to forward thinking rivals. Yet for those to evolve there is a chance to tap into customer bases and enhance operational efficiency. It is essential for established banks to develop business models of swiftly adapting to these transformative trends.