The Impact of AI on Credit Card Approvals

Anúncios

The financial industry has experienced a profound shift due to the rise of artificial intelligence (AI), particularly in the domain of credit card approval procedures. AI algorithms, leveraging techniques like machine learning and neural networks, bolster precision and efficiency in assessing credit risk. By scrutinizing extensive datasets, identifying intricate patterns, and making data-driven judgments with minimal human intervention, AI streamlines the credit approval process, benefiting both lenders and applicants.

These intelligent systems utilize a range of metrics and data gleaned from platforms such as application processing and account management systems to forecast an applicant’s creditworthiness. In the realm of credit scoring, AI’s predictive models are increasingly valuable for their capacity to analyze and learn from complex, unstructured data. AI-powered credit analysis provides financial institutions with a nuanced comprehension of risk factors, resulting in more informed lending decisions and the potential for decreased defaults.

Anúncios

Moreover, the integration of explainable artificial intelligence (XAI) endeavors to fuse sophisticated AI decision-making with transparency. Acknowledging the necessity for comprehensible credit decisions, XAI initiatives strive to render AI-driven credit assessments as intelligible to human evaluators as they are precise. This not only bolsters consumer confidence but also aids institutions in adhering to regulatory requirements that demand accountability in automated decision-making procedures.

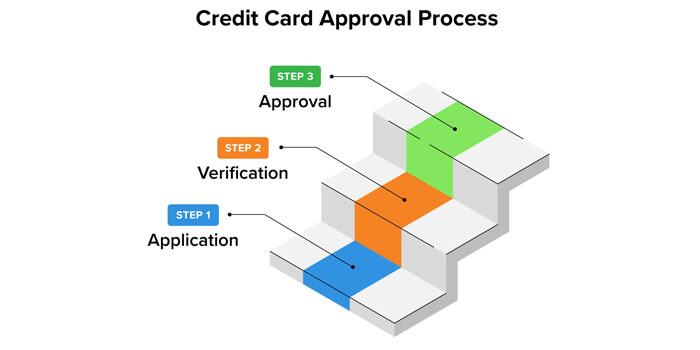

Evolution of Credit Card Approval Processes

The paradigm shift from manual processing to intelligent automation represents a profound evolution in the modus operandi of financial institutions concerning credit card approvals. The advent of advanced technologies such as artificial intelligence and machine learning has precipitated the obsolescence of conventional methodologies in favor of sophisticated algorithms adept at expeditiously and precisely evaluating creditworthiness.

Anúncios

This transition underscores a pivotal juncture in the industry, where the integration of vast datasets and predictive analytics has not only streamlined approval procedures but also elevated decision-making processes, thereby optimizing outcomes for stakeholders across the lending spectrum.

From Manual to Automated Review

Initially, credit card approvals were conducted manually. Financial analysts reviewed paper-based applications, analyzing various financial documents and applicant information. This process was time-consuming and prone to human error, which led to a need for more efficient methods. Automated systems were developed to speed up the process, employing rule-based algorithms that could make quicker, consistent decisions based on a predefined set of criteria.

Early AI Integration in Finance

The integration of artificial intelligence (AI) began to transform finance by introducing machine learning models that could further enhance decision-making. These models, trained on historical data, became more adept at predicting creditworthiness and identifying potential fraud. Institutions could automate complex decision processes, allowing for real-time credit scoring and a more nuanced analysis of credit risk.

Core AI Technologies in Credit Scoring

The advent of Artificial Intelligence (AI) marks a paradigm shift in credit card approval procedures, offering a range of efficient, dependable, and scalable credit scoring methodologies. Financial institutions are embracing sophisticated AI technologies to augment decision-making accuracy and velocity, revolutionizing traditional approaches to credit assessment.

Through the integration of AI, financial institutions can streamline credit card approval processes, enhancing efficiency and reliability while catering to the evolving needs of consumers. These advanced technologies enable institutions to analyze vast datasets with unprecedented speed and accuracy, facilitating informed decisions that optimize risk management and enhance customer experience.

Machine Learning Algorithms

Machine learning algorithms form the backbone of AI-powered credit scoring systems. These algorithms analyze historical data to predict future behavior. Supervised learning models, like logistic regression and decision trees, categorize applicants by their likelihood of defaulting. Unsupervised learning methods detect anomalies and patterns without explicit labels.

Data Analysis and Pattern Recognition

AI excels at identifying complex patterns within data. Credit scoring AI systems employ advanced algorithms that process vast amounts of information, including credit history, transaction records, and social data. They recognize patterns indicating financial behavior, like spending habits and payment reliability, to assess creditworthiness.

Neural Networks and Deep Learning

Deep learning, a subset within the field of machine learning, employs intricate neural network architectures comprising multiple layers to emulate the cognitive processes underlying human decision-making. In the context of credit scoring, neural networks demonstrate proficiency in processing unstructured data, encompassing textual narratives and visual representations, facilitating a comprehensive appraisal of an applicant’s financial status.

Notably, convolutional neural networks (CNNs) and recurrent neural networks (RNNs) exhibit remarkable aptitude in deciphering intricate data sequences and image-based inputs, thereby augmenting the precision and efficacy of credit evaluation procedures.

Benefits of AI in Credit Decisions

Artificial Intelligence has ushered in a profound transformation in the realm of credit decisions, delivering a multitude of benefits. From streamlining processes to crafting personalized financial solutions that cater to individual needs, AI has revolutionized the way credit decisions are made. Its ability to analyze vast amounts of data and identify patterns enables more accurate and efficient decision-making, ultimately enhancing the overall customer experience and facilitating better financial outcomes.

Increased Approval Speed

AI systems significantly reduce the time required for credit application assessments. By automating routine tasks, credit approvals that once took days can now be processed in a matter of minutes. The quick processing is due to the AI’s capability to analyze vast datasets rapidly, leading to faster decision-making.

Improved Accuracy and Consistency

AI enhances the precision of credit scoring by consistently applying complex algorithms, reducing human error. It consistently assesses applications based on a set of criteria, which results in a uniform and fair evaluation for all applicants. The literature highlights AI’s advantage in increasing the overall classification accuracy of credit evaluations.

Enhanced Fraud Detection

AI systems are adept at identifying potential fraud by detecting anomalies and patterns that may indicate suspicious activities. They continuously learn from new data, improving their fraud detection capabilities over time. This aspect of AI provides financial institutions with a robust defense mechanism against fraudulent credit applications.

Personalized Credit Offers

AI’s data analysis proficiency allows for the creation of customized credit offers tailored to individual financial behaviors and needs. By examining spending habits and payment history, AI can offer personalized financial products that suit a customer’s unique circumstances, enhancing customer satisfaction and loyalty.

Challenges and Ethical Considerations

The incorporation of artificial intelligence (AI) into credit card approval processes poses a plethora of ethical and procedural challenges for financial providers. These challenges span from the imperative of maintaining fairness and transparency in decision-making to the rigorous adherence to regulatory mandates and the protection of sensitive customer data.

Navigating this intricate landscape demands meticulous consideration and strategic planning to mitigate potential risks and ensure compliance with ethical and legal standards. Financial institutions must strive to strike a delicate balance between harnessing the efficiency-enhancing capabilities of AI and safeguarding against biases, privacy infringements, and other ethical pitfalls that may arise in the deployment of advanced technologies.

Bias and Fairness Issues

Artificial intelligence systems rely on data to make decisions, and if the data reflects historical biases, these systems may perpetuate or even exacerbate such biases. Providers must rigorously test AI models for fairness to ensure that credit card approvals do not unfairly discriminate against individuals based on race, gender, or other protected characteristics.

Regulatory Compliance

Financial institutions must adhere to a complex framework of regulations that govern credit approval processes. As AI systems become more prominent, they must be designed to comply with existing laws like the Equal Credit Opportunity Act (ECOA) in the United States, which prohibits discrimination in lending.