Potential of Asset Tokenization in the Real Estate Market

Anúncios

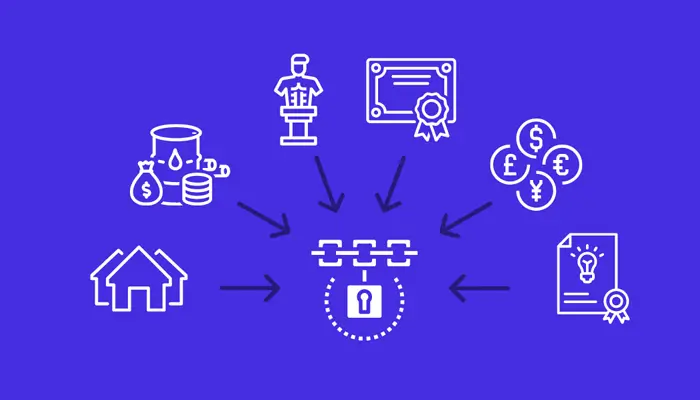

Tokenizing assets, in the real estate industry is an evolving trend that utilizes technology to transform physical properties into digital tokens. These tokens symbolize ownership interests or shares in estate enabling ownership and enhancing liquidity in real estate investments. The introduction of this technology signifies a change in investment strategies aiming to democratize access and streamline transactions while upholding the security and permanence associated with blockchain.

The real estate tokenization market was valued at $2.7 billion in 2022. Is expected to grow in the coming years. Industry analysts project that by 2030 this market could reach a $16 trillion. The inclusion of estate within the securities realm, where it holds a prominent position highlights how tokenization has the potential to revolutionize asset management and investment practices within the sector.

Anúncios

There are benefits to incorporating tokenization into estate. It enables ownership making it more accessible for a range of investors to engage with the real estate market. By tokenizing assets challenges such as entry costs and lack of liquidity are effectively addressed, paving the way, for an inclusive investment environment.

Moreover incorporating technology, in this industry signifies increased transparency and effectiveness in transactions potentially drawing an influx of investments and attention to the real estate sector.

Fundamentals of Asset Tokenization

In the changing world of estate asset tokenization has become a game changer merging traditional property investment methods with modern blockchain technology. This innovative strategy involves converting real estate assets into tokens on a blockchain platform allowing for shared ownership and simplifying investment procedures.

Anúncios

While asset tokenization brings prospects, like improved liquidity, access to investors and increased transparency it also brings about issues concerning adherence to regulations, security measures and the necessity for strong infrastructure. As the real estate sector adapts to this shifting environment understanding the advantages and obstacles of asset tokenization is crucial, for stakeholders looking to leverage its advantages while managing risks effectively.

Definition and Concept

Tokenizing assets, in the real estate sector involves transforming property rights into tokens on a blockchain. Each token symbolizes a share of ownership in the asset. Can be exchanged similar to stocks in markets. This segmentation of property into portions promotes inclusivity, in investment enabling a range of individuals to participate in the market.

Technology Behind Tokenization

The main technology used for asset tokenization is blockchain, an transparent ledger that logs transactions. Each token created on the blockchain is distinct, safe and linked to an asset. This transparency, in ownership of tokens makes it easier to track them reducing fraud risks and simplifying transactions.

Advantages and Challenges

Advantages:

- Increased Liquidity: Real estate tokens can be bought and sold on exchanges, often with lower minimum investment thresholds, thus providing more liquidity to an otherwise illiquid asset class.

- Accessibility: Investors can partake with smaller capital, making real estate investment more accessible to a broader audience.

- Efficiency: Transactions on the blockchain can reduce processing times and costs by eliminating intermediaries.

Challenges:

- Regulation: The legal framework governing tokenized assets is still developing, and compliance with various jurisdictions is complex.

- Market Adoption: While promising, the concept is new and requires broader market acceptance and understanding.

- Technical Understanding: The integration of real estate and blockchain demands a certain level of technical knowledge, which can be a barrier for some investors.

Asset Tokenization in Real Estate

Tokenizing assets is changing the game, in real estate investment by making it easier to invest and giving people the chance to own a piece of property. This process involves turning real estate assets into tokens on blockchain platforms allowing them to be bought and sold by a range of investors. The advantages of asset tokenization are significant including improved liquidity, opportunities for ownership lower barriers to entry for investors and increased transparency in transactions.

Despite these benefits there are still challenges that need to be addressed before asset tokenization can become more widespread, such as issues, security risks and the need for infrastructure to support tokenized assets. Overcoming these obstacles will be crucial for realizing the potential of asset tokenization, in estate as the market continues to develop.

Market Overview

The real estate industry is starting to adopt tokenization with an estimated market value set to reach $16 trillion by 2030. Tokenization entails generating tokens that symbolize ownership of real estate properties allowing for their exchange, on networks. As of 2022 the real estate tokenization market was valued at $2.7 billion indicating a rise in enthusiasm, for this investment approach.

Benefits for Real Estate

Tokenization provides benefits that have the potential to transform real estate investment;

- Enhanced Liquidity: Digital tokens allow trading, on a scale making investments accessible to an investor base and simplifying transactions for quicker and smoother deals;

- Cost Effectiveness: Utilizing technology cuts down transaction expenses by streamlining procedures and decreasing reliance, on middlemen;

- Fractional Property Ownership: Investors have the opportunity to acquire ownership of properties reducing the initial investment threshold and enabling diversification of investment portfolios.

Barriers to Adoption

While the potential of real estate tokenization is considerable, several challenges could slow its growth:

- Regulatory Hurdles: A lack of clear legal frameworks for digital assets can create uncertainty among investors and issuers.

- Market Familiarity: Traditional investors may be hesitant to embrace a technology-driven approach to real estate, preferring established investment methods.

- Technical Complexity: Implementing and maintaining blockchain infrastructure requires technological expertise, which could be a deterrent for some market participants.

Regulatory Environment

Navigating the rules and regulations surrounding asset tokenization, in estate is quite complex with a range of laws that differ from one place to another. This intricate regulatory framework poses a challenge for those involved in tokenization projects demanding attention to detail and a solid grasp of local legal systems. Adhering to these regulations is crucial to minimize risks and ensure that tokenized assets are legitimate.

Important factors to consider include securities laws, property rights regulations, anti money laundering (AML) and know your customer (KYC) rules, tax legislation and data protection laws. It’s also essential for there to be regulations and efforts towards alignment to support the growth of asset tokenization in estate and unleash its full potential. With the regulatory landscape constantly changing stakeholders must stay alert and proactive in addressing compliance issues to encourage sustainable development of real estate markets, on a global scale.

Existing Legal Framework

The existing legal structures that oversee property deals and financial instruments play a role in the process of tokenizing assets. Different countries have regulations concerning property ownership, securities and investments that are relevant not, to traditional transactions but also to digital ones. For instance in the United States tokenized real estate holdings might fall under securities regulations imposed by the SEC. Similarly within the European Union the Markets in Financial Instruments Directive (MiFID II) sets forth a framework that could potentially be applicable, to assets depending on each individual member states laws.

International Standards and Compliance

Anti Money Laundering (AML). Know Your Customer (KYC) regulations play a role in the process of tokenizing real estate assets. Global organizations, like the Financial Action Task Force (FATF) provide guidelines that influence how tokenization should comply with regulations in transactions across borders. Token issuers are required to follow the FATF Recommendations to prevent the use of cryptocurrencies for activities, like money laundering and financing terrorism.

Regulatory Advances and Hurdles

The progress of establishing rules, for real estate tokenization. Is still in the works in regions. Certain countries are actively working on creating regulations to accommodate the rise of real estate tokenization while others may interpret laws to address or exclude tokenized assets.

For instance:

- Switzerland has taken an approach with FINMA offering guidelines on digital assets;

- Malta has passed laws focused on overseeing assets and ensuring investor safety.

Regions often face challenges, in balancing the innovation of asset tokenization with safeguarding consumers and maintaining market integrity.

Case Studies and Future Outlook

The exciting possibilities of using asset tokenization in the real estate market are clearly demonstrated by the rise of projects and the growing confidence, among investors. In this section we will look closely at examples to highlight tokenization efforts and how they are influencing the real estate industry. By examining these instances we can learn more about the advantages and obstacles of asset tokenization and its ability to transform property investment.

Additionally we will investigate investor attitudes towards real estate tokenization pinpointing what drives interest and areas that raise concerns. Drawing on this analysis we will make guesses about where real estate tokenization’s headed in the future taking into account regulatory changes, technological progress and market trends. Through this exploration our goal is to offer insights, into how asset tokenization can revolutionize the real estate sector and what it means for investors, developers and other industry stakeholders.

Pioneering Projects in Tokenization

The field of real estate tokenization has made advancements with companies, like BlackRock delving into the tokenization of extensive asset collections. A recent article in Forbes highlighted the growth of real estate tokenization, which has reached a market value of $2.7 billion in 2022 indicating an expansion within the sector. Projects involving tokenization are utilizing technology to enhance liquidity and make real estate investments more accessible, to an audience.

Investor Perspectives

Investors are attracted to tokenized real estate due to its lower entry barriers and enhanced liquidity. Asset tokenization lowers the traditional financial thresholds allowing more participants to engage in real estate investment. A significant advantage is the real-time trading on blockchain platforms, which contrasts with the traditionally illiquid real estate market.

Predictions for Real Estate Tokenization

Real estate tokenization is expected to experience growth with projections suggesting a market value of $16 trillion by the year 2030. The industry is anticipated to gain momentum due, to regulations and advancements in technology making real estate investment more accessible, to a range of investors.